Online SBI E Mudra Loan Application: SBI E Mudra Loan Apply Online is a new service offered by the State Bank of India. This Yojana was started in 2023 to provide struggling entrepreneurs and SMEs with easier access to financing. Therefore, visit sbi.co.in and fill out the SBI E Mudra Online Application Form 2023 if you wish to apply for an SBI E Mudra Loan. Applying for an SBI E Mudra loan online is simple when you follow the steps listed below. Review the document where SBI E Mudra Loan eligibility is covered to finish. Applying online is quick and simple, and you can quickly get the money you require for your business. Apply for an SBI E Mudra Loan Online, which offers financial support and is especially created for small and medium-sized businesses.

The right spot to apply online for an SBI E Mudra loan! Applying online is a quick and effective approach to get the funding you need for your company. You may easily obtain capital to launch or grow your small business with the SBI E Mudra Loan Apply Online. You can submit all the required information and supporting documentation through an easy and user-friendly online application process while being at home or at the office. You can save time and effort by submitting your application online, and you can also keep track of its status at any time. Why then wait? Take your company to new heights by applying for an SBI E Mudra Loan right away.

SBI E Mudra Loan Apply Online 2023

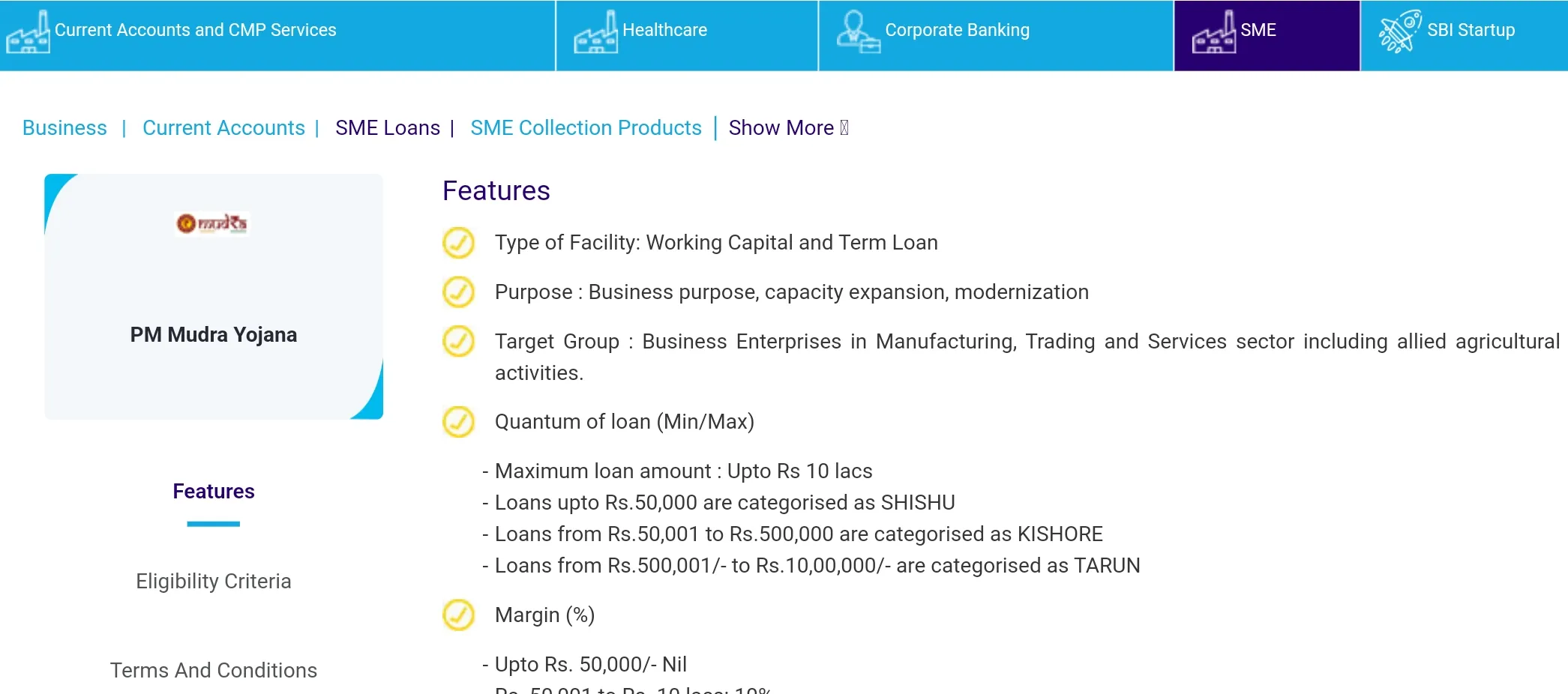

The SBI E Mudra Loan Apply Online was created by the Indian government to support SMEs and small-scale manufacturing. Therefore, SBI and the Government of India collaborated to create the SBI E Mudra Loan Apply Online or PM Mudra Yojana, which enables startups and MSME to obtain loans at extremely cheap interest rates. You can receive credit for running or expanding an existing or new business thanks to this yojana. If you are in the trade services industry, you must take advantage of this advantage. You can get loans ranging from Rs 50,000 to Rs 10,00,000 to aid in your expansion. All entrepreneurs who want to grow their companies require SBI E Mudra Loan Apply Online to raise money.

| Scheme Name | SBI E Mudra Scheme |

|---|---|

| Launch Date | April 8, 2015 |

| Purpose of E Mudra | To provide working capital or Term Loan to Businesses. |

| SBI E Mudra Interest Rate | 9.75% |

| Eligibility | Working or New Units |

| Documents Needed |

|

| Official Website | sbi.co.in |

| Loan Amount | 50,000 to 10,00,000 INR |

| Registration Mode | Online |

| Category | Finance |

Additionally, you can submit an online application for an SBI E Mudra Loan by visiting the bank's official website at @sbi.co.in. See the full announcement on SBI E Mudra Loan Benefits and Eligibility below, along with the 2023 Interest Rate. The three SBI E Mudra loan types for MSMEs—SHISHU, KISHOR, and TARUN—each have a separate eligibility requirement and sanction amount. SBI E Mudra Loan Apply Online offers the lowest Interest Rates and enables you to grow your business. So you should unquestionably obtain it from the SBI branch that is closest to you. You might be required to present the paperwork we have covered below.

About SBI E Mudra Loan

The Bank of Bengal, later known as the Bank of Calcutta, was established on 2 June 1806. This event laid the groundwork for the State Bank of India, which was founded in the first ten years of the twentieth century. The Bank of Bengal was one of three Administration banks, the other two being the Bank of Bombay and the Bank of Madras (which merged on July 1, 1843 and April 15, respectively). The three Administration banks were the result of imperial penalties and were each integrated as commercial companies.

These three banks had the limited authority to issue paper money until the Paper Cash Act of 1861, when the Indian government assumed control of the privilege. On January 27, 1921, the Administration banks merged, and the new financial entity adopted the name Majestic Bank of India. Despite the absence of government involvement, the Royal Bank of India continued to operate as a company.

SBI E-Mudra Loan Interest Rate 2023

Therefore, the table above, in which SBI E Mudra Financing prices are listed, should be consulted by anyone interested in learning more about PM SBI E Mudra Yojana Loan rates for 2023. When you start paying back your credit, you must pay 9.75% interest on the advance amount.

| Category | Interest Rate (p.a.) | Margin (% of project cost) | Loan Amount (up to) |

|---|---|---|---|

| Shishu | 9.75% | Nil | 50,000 |

| Kishor | 9.75% | 10% | 50,000 to 5 lakhs |

| Tarun | 9.75% | 10% | 5 lakhs to 10 lakhs |

| Antodaya | 9.75% | 10% | 10 lakhs to 15 lakhs |

How to Apply SBI E Mudra Loan 2023 Online

The competitive interest rate for the e-Mudra loan can change depending on the loan amount, payback period, and other variables. SBI also provides a number of additional advantages and features, such as simple repayment alternatives, adaptable loan terms, and speedy money disbursement, to make the loan application process simple.

Online Apply Step by Step

- Go to the State Bank of India's (SBI) official website and select the "Loans" tab.

- Click on "Mudra Loans" under "Loans" and then pick "e-Mudra" from the drop-down menu.

- To verify that you meet the requirements, carefully review the eligibility requirements and the necessary papers.

- Click the "Apply Now" button and complete the application with all necessary information, including your name, contact information, the amount of the loan, and the term.

- Upload the required paperwork, including identification, address, bank, and business documentation.

- Examine your application, then send it in.

- You will receive an acknowledgment from SBI with a reference number after submitting the application.

- Your application will be examined by the bank, and if accepted, the loan amount will be transferred to your bank account.

Note: To prevent any delays or rejections in the loan approval process, it is crucial to supply accurate information and all required documents when filling out the application form.

How to Check SBI E Mudra Loan Apply Online 2023?

Easy activities to be completed subsequently To apply for SBI E Mudra Advance 2023, go online. You can apply and following approval receive the advance amount directly in your account.

- Open the SBI Web Portal by going to sbi.co.in first.

- Next, select SBI E Mudra Credit Scheme 2023 under MSME Loans.

- Following that, you will notice Eligibility, Terms and Conditions; click the Apply Online button here.

- You can now access the SBI E-Mudra Yojana 2023 Online Request Form.

- Complete the necessary information on the form, and then move on.

- You must select the give in button upon the completion of the form.

- Finally, you have completed the online SBI Mudra Yojana application process.

- Wait 3 to 5 days for processing and bank approval.

SBI eMudra Loan Benefits

All of the benefits of SBI's Mudra Credit under the PM Mudra Yojana 2023 are listed in the areas below. Examine these benefits, which will make it easier for you to continue working without worrying about your resources.

- With the help of this program, you can finance the expansion of your company.

- This Yojana offers loans up to Rs 10 lakh without requiring any guarantees.

- National Credit Guarantee Trustee Company and Credit Guarantee for Micro Units are the organizations that have authority over this program. There is now a requirement for a guarantee.

- Up to a five-year term, you may borrow money and repay it.

- The PM E Mudra Yojana 2023 charges a minimal attention rate.

- To obtain a loan under this Yojana, a good CIBIL score is not required.

- Credit-based Mudra Yojana comes with a Repay Card.

- SBI E Mudra Loan Online Apply 2023 allows you to expand your company.

Eligibility Criteria for E Mudra Loan

SBI E Mudra Loans are a fantastic choice for people who want to launch a new business or grow an existing one. Non-cooperative small companies (NCBS) in both urban and rural areas are eligible for these loans. Small manufacturing units, service sector units, shop owners, fruit and vegetable vendors, food service units, repair shops, machine operators, small industries, and more are all included in the NCBS.

Applicants must show a workable business plan and a profitable company model in order to be eligible for a Mudra loan under the Shishu category, which is designed exclusively for startups. Under this category, a loan can only be obtained up to a limit of Rs. 50,000.

Businesses of any stage of development may apply for Mudra loans under the Kishore or Tarun programmes. By modernizing machinery and equipment, the business can use these loans to grow.

Important Documents SBI E-Mudra Credit 2023

For SBI E mudra Yojana Credit Apply Online 2023 to be guaranteed, you may need to create the following documents. To qualify for the SBI E Mudra Credit Plan, make sure your records are organized properly.

- Aadhar Card

- PAN Card.

- Business Entity Name

- Address of Business

- Services Offered in Business.

- Business Details and Papers.

Important Links of SBI E Mudra Loan

| Direct Link To Apply SBI E Mudra Loan | Click Here |

|---|---|

| Visit Official Website | Click Here |

| Join Us For Regular Updats | Click Here |

| Join Our WhatsApp Group | Click Here |

FAQ'S on SBI E Mudra Loan

What is SBI e-Mudra Loan?

The State Bank of India (SBI) provides the SBI e-Mudra Loan to micro and small businesses (MSEs) in India. It is a government-sponsored plan to give these businesses financial support and foster their expansion.

Who is eligible for SBI e-Mudra Loan?

SBI e-Mudra Loans are available to micro and small businesses (MSEs) operating in the manufacturing, trading, and service sectors. The loan is also accessible for small enterprises that do not generate their income from farming, including weavers and artists.

What is the loan amount that can be availed under SBI e-Mudra Loan?

Depending on the borrower's creditworthiness and the type of business, the SBI e-Mudra Loan's loan amount might range from 50,000 to 10 lakhs rupees.

What is the repayment period for SBI e-Mudra Loan?

Depending on the loan amount and the type of business, the SBI e-Mudra Loan repayment period ranges from 3 to 5 years.

What is the interest rate charged for SBI e-Mudra Loan?

The SBI e-Mudra Loan's interest rate is determined by the loan amount and the kind of business. It normally falls between 12% and 16% annually.

Conclusion

E Mudra Loan from SBI Your location is ideal! It is simple and convenient to apply for this loan online. The first step is to go to the State Bank of India (SBI) official website and find the E Mudra Loan area. Here, you will discover all the information you need about the loan, such as the qualifying requirements, required paperwork, and interest rates. You can complete the online application form and submit it electronically once you have acquired all the necessary documentation. After reviewing your application, the SBI team will get in touch with you to provide additional instructions.